Introduction

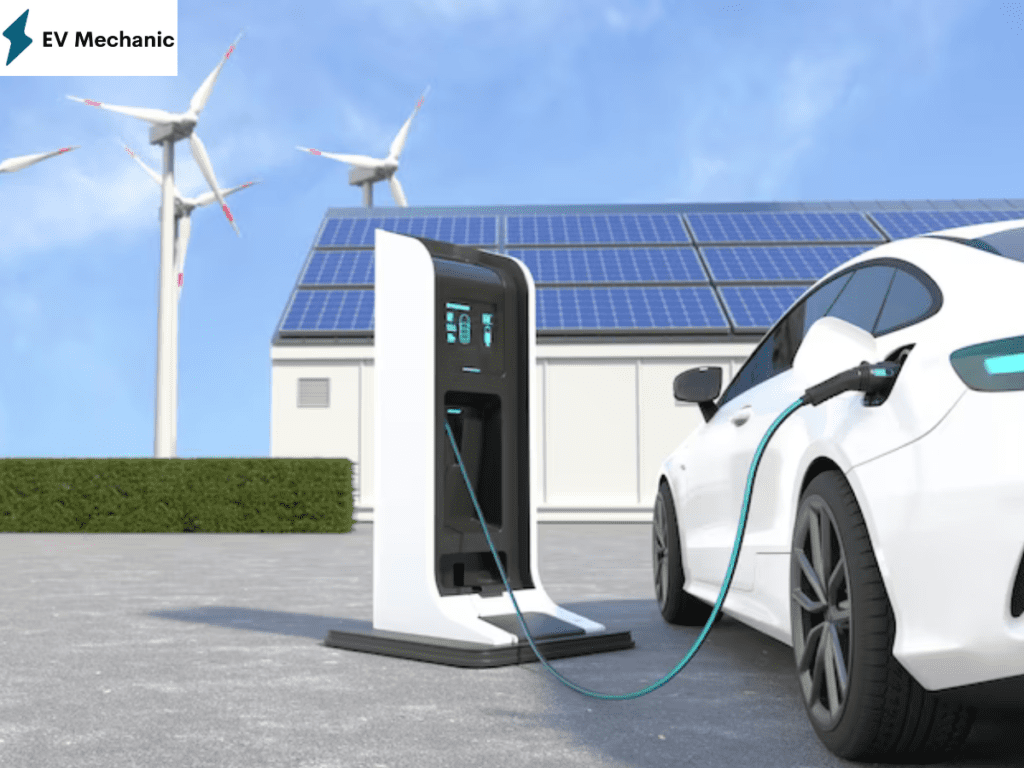

As the world embraces electric vehicles (EVs) for a greener future, the demand for public EV charging stations grows rapidly. These essential charging infrastructures facilitate electric mobility, providing easy access for EV drivers to recharge their cars. However, the introduction of the Goods and Services Tax (GST) in certain regions may have implications for EV drivers utilizing these charging stations. Stay informed about the evolving landscape of EV charging stations amidst the GST implementation.

GST and its Impact on EV Charging Stations

Governments in certain nations have begun charging GST on services provided at public EV charging stations. EV owners have been debating this move and worries have been voiced about the possible effects it may have on the development of electric transportation. Let’s investigate further to comprehend the motivations behind this choice and its potential repercussions.

Reasoning Behind GST on EV Charging Stations

The main goals of imposing GST on EV charging stations are to generate income and promote the expansion of the infrastructure for charging vehicles. The need for charging stations grows along with the number of EVs on the road. Governments can raise money for the growth and upkeep of public charging networks by making charging services subject to GST. Additionally, the introduction of GST on EV charging is considered as a method to level the playing field with other industries and guarantee that the EV industry contributes to the nation’s tax receipts in the same way as other sectors.

Potential Impact on EV Owners

For EV owners, the introduction of GST on charging services may translate into slightly higher costs when charging their vehicles at public stations. While the impact on individual charging sessions may be relatively small, frequent users and long-distance travelers may notice a slight increase in their charging expenses. However, it is essential to note that the revenue generated from GST could be used to enhance the charging infrastructure, ultimately benefiting the EV community.

Encouraging Home Charging Solutions

As public charging stations are the main exception to the GST rule, EV owners may look into alternative charging methods to lessen the financial impact. Owners of EVs are increasingly utilizing home charging options to conveniently overnight charge their cars. Since home charging stations are free from GST, they are a more affordable solution for recurring charging requirements. To further encourage green mobility, governments may want to explore offering incentives for the installation of home charging stations.

Advocating for Transparent Charging Costs

To ensure a smooth transition to GST on EV charging, transparency in charging costs is crucial. Charging station operators should clearly communicate the GST component in their charging tariffs, allowing EV owners to understand the exact cost breakdown. Additionally, governments and industry stakeholders can work together to establish standard charging practices and reasonable tariffs to avoid any potential discrepancies.

Conclusion

The expansion of EV charging infrastructure is essential for promoting the wide use of electric vehicles. While the introduction of GST on charging services may cause EV owners’ prices to increase marginally, it also gives a chance to invest in and advance the infrastructure for charging. In order to achieve a balance between producing income and supporting sustainable transportation, governments, and industry stakeholders must work together.

Despite the potential cost implications, the introduction of GST also presents an opportunity for governments and industry stakeholders to invest in and advance the infrastructure for charging. By directing the generated income towards further development and improvement of the EV charging network, they can significantly enhance the accessibility and efficiency of electric vehicle charging.

Explore the top-notch Digital Marketing Services by visiting the leading Digital Marketing Agency.

I like the helpful info you provide for your articles.

I’ll bookmark your weblog and take a look at once more right here frequently.

I’m reasonably sure I’ll be told a lot of new stuff

right here! Good luck for the next!

[…] approach to electric cars is equally trailblazing, and its compact SUV embodies this vision. Electric power and SUV […]